For anyone looking to start or purchase a business, the industry that the business is in is of critical importance. If the industry is growing or stable over time, this can provide a firm foundation for a business. If the industry is declining, on the other hand, it is more difficult for businesses to survive.

For those that have an interest in property, you may be aware that the government have implemented a number of changes that have affected the lettings industry and that the prospective further changes are still planned.

Many see change as an obstacle but, if recent experience is anything to go by, letting agents who work for the Belvoir Group have been beneficiaries of industry changes.

In this article, we will run through a number of concerns raised by people considering the lettings industry as well as a number of recent and proposed legislative changes and show how these have affected our agents, often in an extremely positive way.

Is Increased Regulation Forcing Landlords Out of the Market?

This is a common concern of people on the outside of the lettings industry. There have been a number of changes that have had significant effects on landlords. One example is the removal of mortgage interest tax relief for residential landlords.

In 2017, the government began phasing in a new tax scheme that meant that, while borrowing money through a buy-to-let mortgage used to be extremely tax efficient, this is no longer the case. Since April 2020, landlords have no longer been able to deduct any of their mortgage payments from rental income in order to reduce their tax bill.

It was perceived that this would cause an exit of landlords from the market as they would be unable to make any money. However, as the scheme only applied to private landlords who owned their properties as individuals or couples (rather than to properties owned by limited companies), landlords that purchased or held properties in limited companies would not be taxed in the same way.

In reality, the scheme hasn’t affected the number of properties on the lettings market but has rather favoured landlords using limited companies which has provided the government with more transparency over the industry (likely the intended effect).

The Renters Reform Bill

Renters Reform Bill is the main change in legislation that is affecting the lettings industry at present. It was introduced to Parliament in May 2023 but is going through a protracted parliamentary process before it becomes law.

Proposed are a number of reforms including banning no fault evictions, changing legislation for pets in let properties, introducing a property portal and having an ombudsman.

Change brings worry for any industry but Belvoir Group’s letting agents are in a position to benefit from this because legislative changes are not always dealt with effectively by self-managed landlords and it can increase the burden on landlords in general.

Because of the Group’s compliance team, we are able to provide clear guidance to our agents and our agents are able to ensure that all of their landlords remain compliant through any legislative changes. We have found this to be a significant selling point when speaking with landlords, enabling us to grow the number of landlords our agents have as clients and properties they have under management.

Interest Rates

One of the most obvious changes to the housing market in recent months has been the increase in interest rates. In 2021 and 2022, Someone with £100,000 pound interest only mortgage at a rate of 1.5% interest would be paying £125 per month. In 2023, at an interest rate of 6%, that same person would be paying £500 per month. With increased costs of financing and with a significant proportion of bite to let landlords having vital and mortgages that need to be refinanced fairly regularly, there was a concern that landlords might prefer to sell than to continue.

Every cloud has a silver lining, however. because rental demand outstrips supply and because of increased inflation and interest rates, rental incomes have kept ahead of landlord finance costs in general.

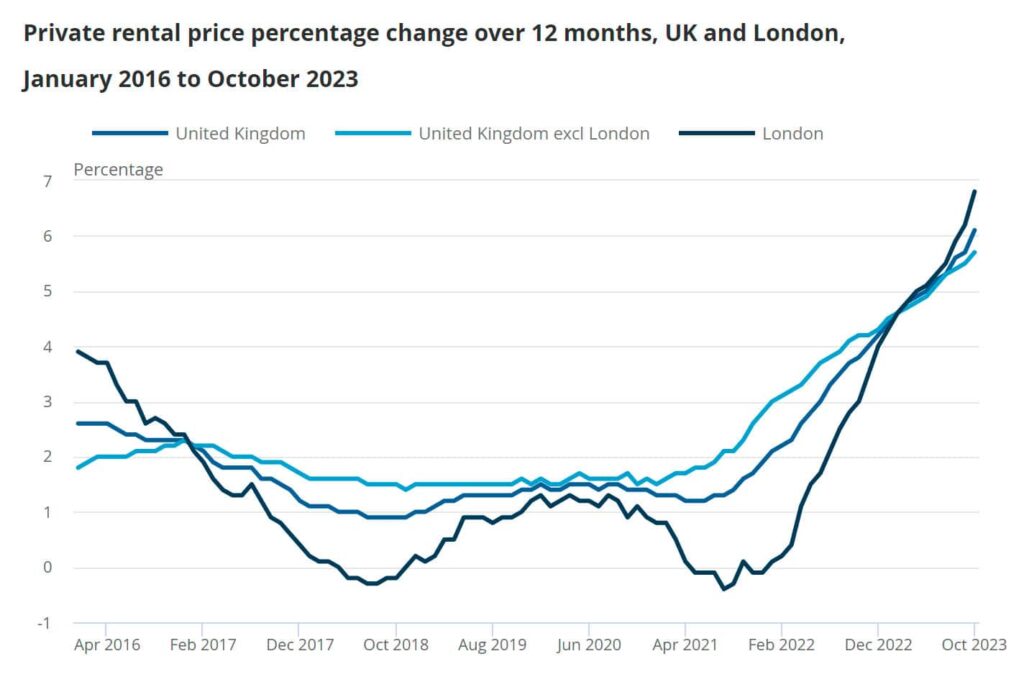

In the 12 months to October 2023, rental prices increased by 6.7% in the UK. Not only are landlords not exiting the market but letting agents are also earning increased fees because, in many cases, their fees are a percentage of rental income. According to the Goodlord state of the lettings industry report, 77% of letting agents so increased demand from tenants looking for a home. In this regard, there is significant demand for rental properties increasing rental prices: this, in turn, puts pressure on the market to make available more rental properties.

What Other Legislation is Affecting the Lettings Industry?

In 2020, the government announced plans to increase Minimum Energy Efficiency Standards for the private sector. This would involve all newly rented properties to have

the EPC band “C” by 2025. Although this legislation is currently on hold, any changes in this direction will offer an opportunity to a letting agent that is able to coordinate improvements on behalf of landlords, especially portfolio landlords who may have a number of properties that do not quite meet the rating. Letting agents are generally very confident that they will be able to help their landlords cope with any future legislation changes for energy performance regulations

How Big is the Private Rental Market in the UK?

According to the government’s English Housing Survey 2022 to 2023: headline report – GOV.UK (www.gov.uk), the number of households in the private rental sector increased from 4,434,000 to 4,611,000 (up 4%) between 2020-21 and 2021-22, and fell by only 0.3 to 4,595,000 in 2022-23. This was still a level higher than in any other year other than 2016-17. This is a far cry from the impression one might get from reading the press over the past two years. The private rental sector still represents 19% of all households as it has been since 2017-18.

What if a Landlord Wants to Sell?

For the agents of the Belvoir Group, a landlord looking to sell their property is an opportunity rather than a problem. Our agents are equipped to help landlords sell their property and often have a database of ready buyers. This helps the landlord wishing to sell and provides fees for the agent. In addition, our letting agents have good relationships with portfolio landlords who are looking to expand.

In many cases, these portfolio landlords would be interested in purchasing any buy-to-let properties that come to market, it is possible for a letting agent to not only earn the fees from the disposal of the property but also to retain the property on their books with a new landlord.

If you enjoyed reading this article, you might also like Franchise Growth by Acquisition – Purchasing a Lettings Business and Estate vs letting agency franchise: What is the difference and which one is right for you?